Fsa Plan Year Vs Calendar Year – while others opt for the calendar year. The plan year applies to products that a company sells, not an accounting period for a corporation. The insurance and investment industries use plan years. . It’s not clear, however, what share of people with access to an FSA each year actually use it. There also are limited-purpose FSAs or dependent-care FSAs. To learn about these plans, talk with .

Fsa Plan Year Vs Calendar Year

Source : cosmoins.com

Plan Year Vs. Calendar Year | Decent

Source : www.decent.com

Calendar Year versus Plan Year — and why it matters for your

Source : mylife-ts.adp.com

Mid Year Medical Plan and Calendar Year FSA? The Options Aren’t Ideal.

Source : www.linkedin.com

Employee Benefit Plan Limits for 2023 | Stone Tapert

Source : www.stonetapert.com

FSA vs. HSA: Which camp are you? | BRI | Benefit Resource

Source : www.benefitresource.com

Plan Year Vs. Calendar Year | Decent

Source : www.decent.com

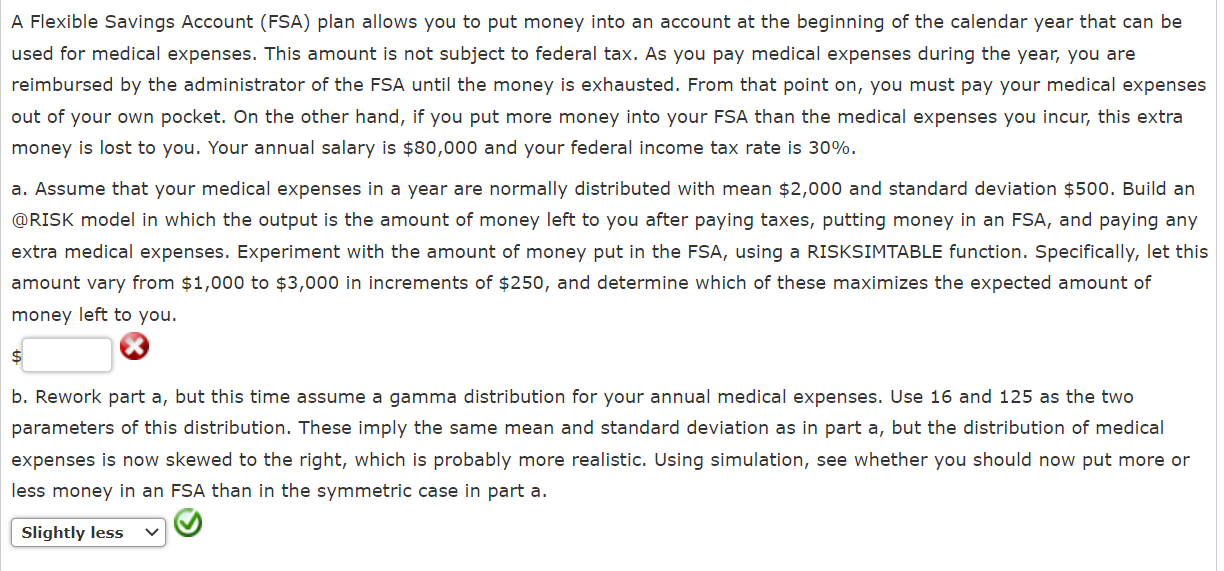

Solved A Flexible Savings Account (FSA) plan allows you to | Chegg.com

Source : www.chegg.com

Plan Year Vs. Calendar Year | Decent

Source : www.decent.com

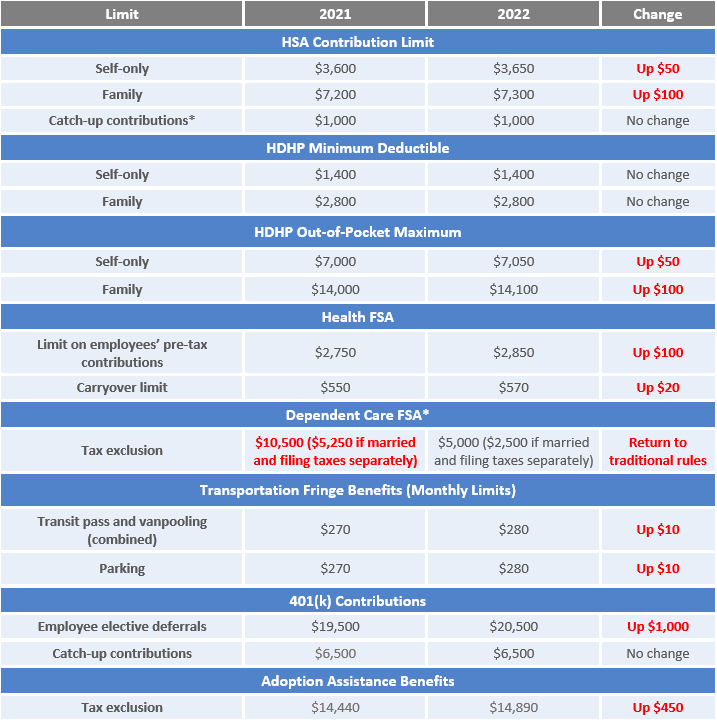

Compliance Overview: Employee Benefit Plan Limits for 2022

Source : www.sanfordtatum.com

Fsa Plan Year Vs Calendar Year Difference Between Group Plan Year & Calendar Year | Best NJ Insurance: In March 2022, the FSA year strategy and vision for the food system, setting out its direction until March 2027. We also published a set of priorities (PDF) to deliver in the first year of the . This grace period extends the 12-month plan year by 2 ½ to contribute to your FSA. “Start by looking at how much you spent out-of-pocket on healthcare the prior calendar year,” suggested .